News

A round up of our latest blogs, commentary or office news. Get in touch if you need more details on any of the topics covered.

Latest posts

Museums and Galleries Exhibition Tax Relief claims

Sean Douglass, Audit Partner at Bates Weston considers Museums and Galleries Exhibition Tax Relief (MGETR) claims – who can claim it, what can be claimed for and what it is worth.

Cost of professional tax advice

HMRC seems to confirm that the cost of professional tax advice does indeed represent good value for money.

Cautious easing of lockdown from 4 July

Which business sectors can reopen under Covid-19 Secure conditions from 4 July and if you can’t observe 2m social distancing, what 1m+ means.

Code of practice for commercial property sector

The Government has published a code of practice for the commercial property sector, creating best practice for negotiating affordable mutually beneficial rental agreements. It was drawn up with the support of leading representative bodies from the sector.

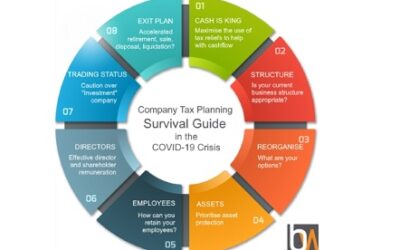

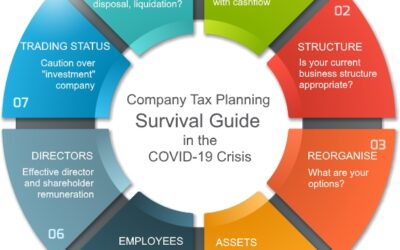

Company tax planning and business structure

Company tax planning is vital when choosing a business structure. Cassandra Graham, looks at the options as part of our 8 part company tax planning survival guide.

How can company tax planning help with cash flow?

Company tax planning can be useful to recover cash from HMRC or to reduce the amount of tax you are expected to pay – both valuable outcomes in managing your cash flow position.

Bates Weston Company Tax Planning Guide

Our tax team have prepared a Bates Weston Company Tax Planning Guide to help you and your business get through the Covid-19 crisis and emerge, ready to respond to the challenges ahead.

Changes to furlough scheme

Summary of the main changes planned for the furlough scheme, ahead of detailed guidance expected from the Government on 12 June

Reclaim higher rate Stamp Duty Land Tax (SDLT)

Planning to reclaim higher rate SDLT paid on your new home because you sold your old one within three years, but Covid-19 delayed your sale? Government announcement could help.

New Dairy Response Fund Announced

Dairy Response Fund, administered by the Rural Payments Agency will cover up to 70% of losses during April and May due to falling milk prices and could be worth up to £10,000 for eligible dairy farmers.

Restructure and reduce risk using a Holding Company

A holding company structure could reduce risk for growing businesses and those with surplus assets. Is it time to reconsider your business structure?

Taxation of Coronavirus Support Payments

Government launches consultation on proposed tax treatment of Coronavirus support grant payments. Responses required by 12 June.

Derby City Council Discretionary Grant Fund – apply now

Check your Local Authority website for details of their application process for the Local Authority Discretionary Grant Fund. Derby City Council’s fund is open for applications now.

Employers to share costs of Coronavirus Job Retention Scheme and SEISS extended

Changes to Coronavirus Job Retention Scheme. Flexible Furlough scheme introduced from 1 July, employers to gradually increase their contribution to wage costs beginning with NI and employer pension contribution costs and rising to 20% by October when the scheme will end. Self Employment Income Support Scheme extended, now ending in August, with a single payment of up to £6,570 to cover June, July and August.