What is a Holding Company? Craig Simpson, Tax Partner at Bates Weston, provides a brief guide.

As a trading company grows and become more profitable, the company can build up surplus assets. These assets can then be used to invest in property or other non-trading assets. Holding these valuable assets within a trading company can expose them to the risks of that trading company. Commercially a different structure may be appropriate and this is where a holding company can be very useful.

What is a holding company?

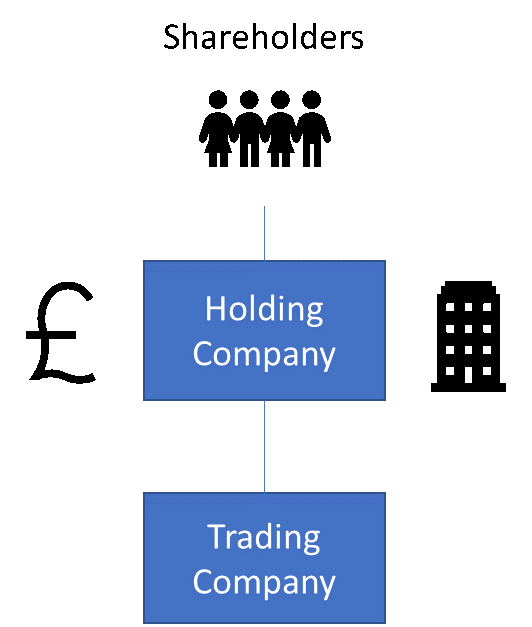

Basically it is a company that sits above the trading company; so rather than owning shares directly in the trading company, the individuals own shares in the holding company. The holding company owns 100% of the share capital of the trading company. It looks like this:

Why have a holding company?

There are a number of reasons to have a holding company.

- It enables the movement of profits from the trading company to the holding company without corporation tax.

- Surplus cash and other investment assets can be moved to the holding company which can ring fence them away from the riskier trading activities. It is common for a holding company to own the trading premises, surplus cash, stocks and share investments, plant and machinery. There are no restrictions to the type of asset the holding company might own.

- As the business expands further, new trades or divisions could be set up in new subsidiary companies to ring fence their activity.

How do I put a holding company in place?

The first step is to review the commercial rationale for inserting the holding company and then to apply for HMRC clearance. Provided HMRC grant clearance for inserting the holding company, it is then a case of implementing the transaction correctly. This is a legal process, reviewed by us to ensure the tax reliefs are maintained. The good news is that it should be possible to insert the holding company without any taxation cost.

How do I know a holding company is right for me?

Speak to us and we can discuss your exact circumstances. Broadly, as a business grows and makes profit levels beyond what is required by the shareholders for day to day living, then a holding company is a worthwhile structure to adopt.

If you would like to know more then please contact Craig Simpson or get in touch with your usual Bates Weston contact.

This guidance is generic in nature and does not constitute advice. You should take no action based upon it without consulting ourselves or your own professional advisor.