Beth Noy, Tax Manager at Bates Weston, considers the use of tax planning, particularly share incentive schemes, in attracting and keeping people who are driven to grow your business.

At a time when cash bonuses are likely to be a rarity, businesses may need to look to other forms of non-cash incentives to retain, reward and incentivise key employees.

For struggling businesses, job cuts may be necessary potentially putting an increased focus on keeping and motivating key employees who have been retained to reinforce job security. For those businesses that are in thriving sectors, the challenge may be in attracting key personnel to join your team and rewarding the staff that have helped to keep “business as usual”.

Employee incentives can include non-cash benefits. These are tax efficient for employees and tax neutral for the company when compared to cash remuneration. In most circumstances, Beth believes a tailored share incentive scheme can be the ultimate carrot, but she cautions that the design and implementation must be done correctly. If not, the tax costs can be painful and tax charges may arise in the future.

The most popular type of scheme is the Enterprise Management Incentive (EMI) scheme but other options such as a Company Share Option Plan (CSOP) and growth share schemes can be just as useful as tax planning tools. They are all powerful incentives, giving the employees involved a vested interest in the survival and growth of a company, something which may be crucial for business survival in the current climate.

With an EMI scheme in particular, participants are given the opportunity to buy shares at today’s discounted market price at a future point, when they should be worth more, with potentially only 10% to pay on the gain of up to £1m and 20% thereafter. That is because the growth in value of the shares is taxed at the current more favourable Capital Gains Tax rates, rather than as income. The company also receives a corporation tax deduction for the growth in value without incurring any cost. The scheme benefits all parties involved and provided certain conditions are met, can be tailor made.

Beth believes HMRC approved share schemes offer a company tremendous flexibility to design a plan with triggers that both incentivise the employee and meet the company’s growth and ownership objectives. If you would like to speak with us about using tax advantaged share structures to incentivise your team, please get in touch with Beth.

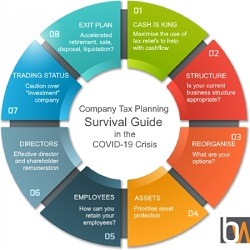

Employee retention through tax planning forms part of Bates Weston’s Company Tax Planning Survival Guide. The guide considers 8 key aspects of tax planning that could help businesses get through the Covid-19 crisis. If you would like to consider whether reorganisation is right for your business or discuss any aspect of our Company Tax Planning Guide, please do get in touch with Beth Noy, Craig Simpson or Richard Coombs.

Disclaimer: The information contained in this article is generic in nature. You should take no action based upon it without consulting ourselves or an alternative professional advisor. All information correct at time of publication: 16 July 2020