In part 7 of our Tax Planning Guide series, Cassandra Graham, Senior Tax Manager at Bates Weston urges us to keep a watchful eye on trading status, as the tax implications are significant.

“There are valuable Capital Gains Tax (“CGT”) and Inheritance Tax (“IHT”) reliefs available to shareholders which are partly dependent on the trading status of your company. If your trading status alters these reliefs may be lost.

Each relief has different qualifying conditions but common to all is the need to be a trading company. Complicating matters further, the definition of a trading company versus an investment company is different depending on the tax in question.

It is necessary to consider five different tests to determine whether the company – in the round – can be considered a a trading company. These tests are:

- assets

- turnover

- management time & expenses

- history

- profitability

For CGT reliefs, the company cannot consist of non-trading activities to a ‘substantial’ extent. HMRC generally interprets substantial to mean 20%. Therefore, using these tests, broadly 80% of the business must be defined as trading to qualify for CGT reliefs. We say “broadly” as in a recent tribunal case – Dr Allam – the 20% test was challenged. The tribunal acknowledged that this 20% was intended as a rule of thumb and not a strict limit or threshold. It was concluded that “to a substantial extent” meant that the non- trading activities must have a material or real importance in the context of the activities of the company as a whole.

For IHT, using the same tests, 51% of the business must be defined as trading to qualify for the reliefs.

The reliefs are valuable. In the case of CGT, Business Asset Disposal Relief (formerly Entrepreneurs’ Relief) gives a tax rate of 10% up to a lifetime limit of £1m . Where shares are gifted, Business Asset Gift Relief enables the gain to be heldover in full (or in part if the company holds investments assets). This means that there may be no CGT triggered (or a reduced amount of CGT) when the assets are given away. For IHT, Business Property Relief can provide 100% relief against the value of your shares for both lifetime transfers and transfers on death resulting in a saving of up to 40% on the value on death.

So, what is the danger?

If during the present trading conditions, you take actions that will affect the proportion of your business that is trading vs investment, you risk jeopardising these valuable reliefs.

We urge you to be vigilant. Keep a careful watch on your management accounts and the above indicators to make sure that a tipping point is not reached.

This may not happen because you have taken specific decisions e.g. to invest in rental property to supplement your income, but rather that if your trading income declines and you already have investment income, the proportions of each may change.

It is important that when short term plans are made to sustain your business through the pandemic, the longer-term tax implications are fully understood.”

If you need our help in considering your options, please do get in touch.

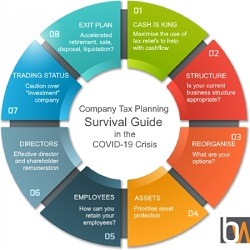

The Bates Weston’s Company Tax Planning Survival Guide considers 8 key aspects of tax planning that could help businesses get through the Covid-19 crisis. If you would like discuss any aspect of our Guide, please do get in touch with Cassandra Graham, Craig Simpson or Richard Coombs.

Disclaimer: The information contained in this article is generic in nature. You should take no action based upon it without consulting ourselves or an alternative professional advisor. All information correct at time of publication: 5 August 2020