A warning not to cut corners on R&D claims

Craig Simpson, tax partner at Bates Weston stresses the need for rigorous attention to detail and issues a warning not to cut corners on R&D claims

Craig Simpson, tax partner at Bates Weston stresses the need for rigorous attention to detail and issues a warning not to cut corners on R&D claims

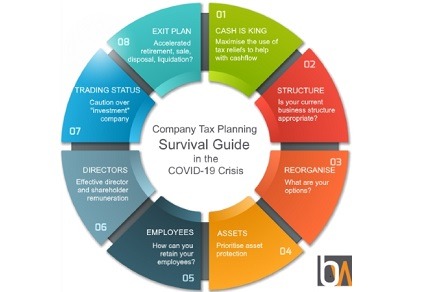

Company tax planning can be useful to recover cash from HMRC or to reduce the amount of tax you are expected to pay – both valuable outcomes in managing your cash flow position.

A holding company structure could reduce risk for growing businesses and those with surplus assets. Is it time to reconsider your business structure?

Government launches consultation on proposed tax treatment of Coronavirus support grant payments. Responses required by 12 June.

HMRC launch a campaign to ensure taxpayers understand when the income tax on Venture Capital Trust (VCT) investments is clawed back, and alter their timescales to reflect the challenging times we find ourselves in.

The Chancellor, Rishi Sunak, announced £1.25 billion of government support for innovative firms at the Downing Street Press Conference on 20 April 2020, delivered through the Future Fund and Innovate UK.