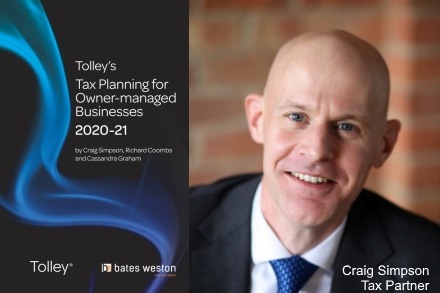

Writing the book on tax

Bates Weston’s tax team update and co-author Tolley’s Tax Planning for Owner Managed Businesses 2020-21.

Bates Weston’s tax team update and co-author Tolley’s Tax Planning for Owner Managed Businesses 2020-21.

Craig Simpson , Tax partner at Bates Weston, looks at the recommendations made by the OTS’ first report on the Capital Gains Tax review requested by the Chancellor.

Bates Weston Tax welcome Liz Pepper to our growing tax advisory team. Major decisions, especially for owner managers, have far reaching impacts. Our job is to help them take the big decisions with confidence. Recognised by Tolleys’ for our work with OMBs, we offer rounded practical tax advice.

Craig Simpson, Tax Partner at Bates Weston considers whether an increase in Capital Gains Tax is on the way, following the Chancellor’s request for a review of Capital Gains Tax in a letter to the Office for Tax Simplification.

Craig Simpson, tax partner at Bates Weston stresses the need for rigorous attention to detail and issues a warning not to cut corners on R&D claims