Cassandra Graham, Senior Tax Manager at Bates Weston, considers the use of tax planning in asset protection.

As your business grows, cash, property and assets are built up within it. In a time of economic uncertainty, thoughts turn to how these business assets can be protected should your business suffer. High level tax planning is needed to weigh-up the options – balancing your future goals without triggering unnecessary tax.

On an individual level, the pandemic forces us to consider mortality, the worst-case scenario and our personal assets and how we might best pass on the wealth we have built up to future generations in a tax efficient way.

So, in this, the fourth in our series of Tax Planning articles, Cassandra Graham looks at the use of holding companies, Personal or Family Investment Companies (“PICs” and “FICs”) and trusts as measures to protect business and personal assets.

- Consider inserting a holding company above your trading company to move assets from the trading company up into the holding company, away from any downturn in trade. It is important to consider the implications of this if the business was to become insolvent. Alternatively, if there is an existing holding company structure in place, consider whether current structure can be utilised for asset protection purposes. Setting the group structure up, the way the assets are moved intragroup and the ongoing tax implications of such a structure all need to be considered.

- For personal asset protection consider the use of trusts for children and future generations. They can be an efficient inheritance tax planning opportunity provided you would like to gift assets away without retaining an interest in the capital or income. Gifts into trust can be structured in a way so that no tax is triggered on the transfer. Making use of gifting assets into trust when they qualify for Business Property Relief (“BPR”) is also a valuable planning technique.

- Alternative personal asset protection can be achieved through the incorporation of Personal or Family Investment Companies (FICs and PICs). They are a way to invest funds via a corporate vehicle, where profits benefit from lower tax rates than would otherwise be assessed if the assets are held personally. In addition, any growth can be passed to onward generations as shareholders in a way which does not enhance the value of your estate for inheritance tax purposes.

Cassandra comments:

“Asset protection is a crucial component of tax planning. Owners who have built up their businesses and personal assets over many years, rightly need to take steps to protect their wealth, providing for their own future plans and ultimately passing on their wealth to their dependents.”

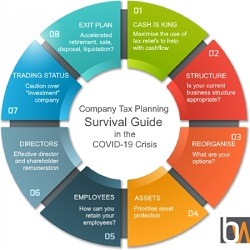

As specialist tax advisors, Bates Weston has produced a Company Tax Planning Survival Guide which considers 8 key aspects of tax planning that could help businesses get through the Covid-19 crisis. If you would like to consider whether reorganisation is right for your business or discuss any aspect of our Company Tax Planning Guide, please do get in touch with Cassandra Graham, Craig Simpson or Richard Coombs.

Disclaimer: The information contained in this article is generic in nature. You should take no action based upon it without consulting ourselves or an alternative professional advisor. All information correct at time of publication: 8 July 2020