In the third in our series of company tax planning articles, Liz Pepper, Senior Tax Manager at Bates Weston looks at the use of merger, demerger and reorganisation as a tax planning tool.

The world has changed. As a shareholder in a business, your priorities may have changed too. Perhaps you no longer share a common view of where your business is headed. Perhaps your attitude to risk or your retirement plans have altered. Perhaps you see opportunities for growth.

Clearly, the pandemic has forced many to rethink their future plans. High level tax planning can allow you to consider tax efficient alternatives to the present structure of your business interests.

Whether that involves resolving shareholder disputes to produce an amicable, impartial tax efficient outcome, splitting out your investments from your trading interests, retaining parts of your business that are doing well and divesting parts that underperform or combining your business with others for mutual benefit – tax efficient demergers, mergers and re-organisations all require high level tax planning and exceptional implementation skills. Importantly, where possible, pre-clearance from HMRC should be obtained so that the tax treatment is known with certainty before undertaking any steps.

At Bates Weston, out tax team thrive on unravelling and resolving complex shareholder issues, so if you need our help please do get in touch.

Liz Pepper, Senior Tax Manager at Bates Weston highlights the following situations where reorganisation may be the way forward:

- Restructuring to dispose of a loss-making part of the business – hiving down part of the business into a subsidiary could be a feasible solution and provided a group has been in existence for more than 12 months it is possible to dispose of the business free of tax.

- Restructuring to separate out an investment business from trading activities into a completely new group, for example, by way of demerger to protect the investment value and assets.

- Restructuring to separate businesses that are to be sold and retained can also be achieved by way of a demerger. This will allow the ultimate sale to be realised personally by the individual shareholders rather than locking the proceeds inside the company/group which can result in double taxation.

- If uncertainty and increased risk has resulted in shareholder disputes and splitting the business into separate ownership is the only way forward to overcome the deadlock, a demerger may achieve this without a charge to tax.

- Conversely, it could also be necessary to merge separate businesses into one group to transfer assets and share resources but it is vital this is done in the correct way to prevent unexpected tax bills.

As Liz points out:

“There are extensive reorganisation and restructure tax provisions which can be applied to ensure that a business is restructured without incurring a huge tax bill. It is vital that high level tax planning advice is taken to ensure the most tax efficient solution both for the short and the long term”.

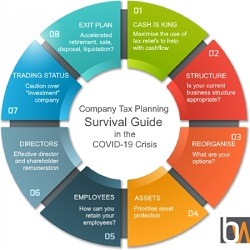

As specialist tax advisors, Bates Weston has produced a Company Tax Planning Survival Guide which considers 8 key aspects of tax planning that could help businesses get through the Covid-19 crisis. If you would like to consider whether reorganisation is right for your business or discuss any aspect of our Company Tax Planning Guide, please do get in touch with Liz Pepper, Craig Simpson or Richard Coombs.

Disclaimer: The information contained in this article is generic in nature. You should take no action based upon it without consulting ourselves or an alternative professional advisor. All information correct at time of publication: 1 July 2020