Company tax planning can be useful in managing cash flow. There are three main scenarios in which it may be possible for us to help you recover cash from HMRC or to reduce the amount of tax you are expected to pay. Both outcomes, can be valuable in managing your cashflow position.

Expect to make a loss this year

Did you pay corporation tax in the previous tax year and are now, or expect to be loss making this year? As soon as your financial year ends, complete your accounts and submit your tax return as quickly as possible to report your loss to HMRC. Your losses can be set against profits in the previous year to generate a valuable refund of corporation tax from HMRC. In some cases it may be valuable to consider shortening your accounting period to crystallise the loss and relief quicker. Work with your accountants and tax advisors to ensure you are prepared to submit your return, having taken into account all possible reliefs for the current year, as soon as possible.

Expect to make a profit this year

Expecting to be profitable this year? Make sure that you are making full use of all available reliefs, including considering accelerating capital expenditure to maximise capital allowance claims while the AIA limit is high and including an R & D tax relief claim where eligible. Talk to your professional advisors about minimising profit and any corporation tax due, to reduce outgoing cash payments.

Review previous years return

Consider your last tax return. Are you confident that all available reliefs were claimed? Ask your professional advisor to review it and consider whether it is possible to pursue a refund of any corporation tax “overpaid”. Provided any necessary changes to the previous return and resultant claim are made within 12 months of the original filing deadline, a refund may be possible, again, helping with cashflow.

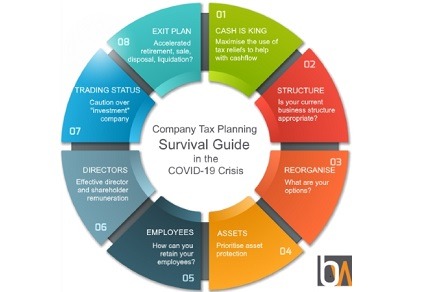

As specialist tax advisors ourselves, we would be happy to talk through your own circumstances, without obligation. Our Company Tax Planning Survival Guide includes the measures we would consider in relation to your cashflow, as well as looking at 7 other key areas.

The cash flow measures in the guide include:

- R & D – Any business which carries on projects which seek to advance science or technology should qualify. Provides additional corporation tax relief of £130 for every £100 of qualifying costs and potential cash back credits of 14.5%.

- Capital Allowances – Ensure your current year capital allowance claims are maximised and your expenditure is accelerated where possible to utilise the £1m Annual Investment Allowance limit for expenditure up to 31 December 2020. Consider historic claims on commercial property or prior year claims to ensure maximum allowances are obtained.

- Patent Box – provides a lower rate of corporation tax for profits earned on patented inventions.

- Structural Building Allowance – provides relief for expenditure on new commercial property constructions at an increased rate of 3%.

- Loss carry back claims – a loss realised in a chargeable accounting period can be carried back 12 months which can generate refunds of tax previously paid. Consider preparing accounts and tax returns early or shortening accounting periods to crystallise the loss and carry back sooner to generate cash refunds.

If you would like our help with cashflow tax planning measures, or with any other aspect of our Tax Planning Guide, please do get in touch with Cassandra Graham, Craig Simpson or Richard Coombs.

Disclaimer: The information contained in this article is generic in nature. You should take no action based upon it without consulting ourselves or an alternative professional advisor. All information correct at time of publication: 11 June 2020